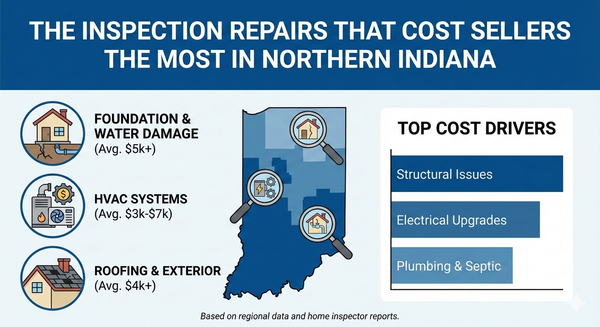

The Inspection Repairs That Cost Sellers the Most in Northern Indiana

The Inspection Repairs That Cost Sellers the Most in Northern Indiana

There's a special kind of panic that hits when your buyer's home inspector finds the thing—that one expensive issue lurking in your basement, clinging to your roof, or hiding behind your electrical panel. And let's be honest: in Northern Indiana, where foundation and structural concerns are among the top issues thanks to our soil conditions and temperature swings, these surprises pop up more often than any seller wants to admit.

After watching countless deals in St. Joseph and Elkhart Counties get derailed by inspection surprises, I've learned something: the furnace always picks closing week to get dramatic. But knowing which repairs hit your wallet the hardest—and when to fix them versus negotiate—can save you thousands and keep your sale on track.

The Big Four: Where Inspection Money Disappears

1. Aging Roofs: The $7,000–$18,000 Wake-Up Call

Your roof is probably fine. Until the inspector climbs up there with a flashlight and suddenly it's a five-alarm emergency. Roof replacement costs in Indiana average $7,355, though prices can stretch anywhere from $5,600 to over $19,000 depending on your home's size and material choices.

What inspectors flag:

- Missing, curling, or damaged shingles (our freeze-thaw cycles are brutal)

- Water stains on ceilings or in attics

- Compromised flashing around chimneys and vents

- Age—roofs over 15-20 years raise red flags even if they look okay

The reality check: Northern Indiana homeowners typically pay $14,000 to $44,000 for full replacements on larger homes with steep rooflines—common in areas like Granger and Mishawaka. For a standard 1,500-square-foot home? Expect $10,000 to $18,000 for asphalt shingles.

Deal killer potential: Moderate. Most buyers understand roofs age, but significant damage or a roof nearing the end of its life can scare off lenders. Many buyers will ask for either a full replacement or a substantial credit—sometimes $8,000 to $12,000 off the purchase price.

2. HVAC Systems on Borrowed Time: $3,500–$12,500

Nothing strikes fear quite like an inspector noting that your furnace "has exceeded its expected lifespan." And in our climate? That furnace isn't optional—it's survival equipment.

What buyers worry about:

- Units over 15-20 years old

- Systems struggling to maintain temperature

- Rusty heat exchangers (potential carbon monoxide issues)

- Ductwork problems or poor airflow

The damage: A full HVAC replacement in Indiana runs $5,000 to $12,000, with gas furnaces costing $2,500 to $7,000 depending on efficiency. For Central Indiana homes, expect to pay $3,500 to $4,800 for smaller homes, while larger 3,000-square-foot properties can hit $7,500 or more.

Here's the thing: everyone knows HVAC systems die eventually. But buyers don't want to inherit that expense in their first winter. An aging system becomes leverage—expect buyers to ask for either a replacement or a credit that covers 75-100% of the replacement cost.

Deal killer potential: High. Lenders may require HVAC replacement if the system is non-functional or poses safety risks. Even if the deal doesn't die, expect significant negotiations.

3. Basement Moisture: The $2,000–$15,000 Creeping Problem

Indiana basements leak. It's practically a state tradition. Between our clay-rich soil and seasonal precipitation, moisture problems aren't a matter of if—they're a matter of when your buyer's inspector will find them.

Common basement red flags:

- Water stains on walls or floors

- Musty odors or visible mold

- Efflorescence (white, chalky deposits on concrete)

- Bowing or cracked foundation walls

- Poor drainage or missing sump pumps

What it costs: Basement waterproofing ranges from $9,500 to $15,000, with interior drainage systems typically running $2,000 to $6,000. Exterior excavation work? That jumps to $400-$600 per linear foot. Foundation repair for horizontal cracks or bowing walls can add another $2,000 to $10,000 depending on severity.

Minor fixes like sump pump installation or basic crack repair might only set you back $800 to $1,500, but if you've got serious water intrusion or structural issues, you're looking at five figures.

Deal killer potential: Moderate to high. Minor moisture issues can usually be negotiated with credits. But significant structural damage or active flooding? That's when buyers walk. Lenders won't approve loans on homes with serious foundation problems.

4. Electrical Panel Updates: The $1,200–$4,000 Safety Issue

Your electrical panel might work perfectly fine—until an inspector points out it's a Federal Pacific or Zinsco panel from the 1970s, both linked to fire hazards from failing circuit breakers.

What triggers replacement demands:

- Outdated or recalled panel brands

- Insufficient amperage (60-100 amps in modern homes)

- Overloaded circuits or double-tapped breakers

- Missing GFCI outlets in bathrooms and kitchens

- Aluminum wiring (common in 1965-1973 homes)

The bill: Electrical panel upgrades typically cost $1,200 to $2,000 for a standard 200-amp service upgrade. The work takes 4-8 hours, with electricians charging $50-$100 per hour. If you need to upgrade from 100 to 200 amps? Expect $1,300 to $2,500. A full 400-amp upgrade runs $2,000 to $4,000.

Deal killer potential: Moderate. Safety-related electrical issues won't necessarily kill deals, but insurance companies can refuse coverage on homes with known hazardous panels. That means no insurance, no loan, no closing. Smart sellers address these proactively.

The Fix-Now-or-Negotiate-Later Dilemma

So should you throw money at repairs before listing, or roll the dice and see what the inspection brings?

The Case for Pre-Listing Repairs

| Pros |

|---|

| Smoother transactions: Fewer surprises mean fewer last-minute negotiations and less chance of buyers walking away |

| Better offers: A clean inspection can justify your asking price and attract more serious buyers |

| Control over costs: You choose the contractor and can shop for competitive bids, rather than accepting inflated estimates from buyers |

| Marketing advantages: "New roof 2025" or "Updated HVAC" are powerful selling points |

| Cons |

|---|

| Upfront expense: You're spending thousands before you even have a buyer |

| No guarantee of return: Not all repairs translate to higher sale prices |

| Time investment: Coordinating contractors delays your listing date |

The Case for Selling As-Is

| Pros |

|---|

| Faster to market: No repair delays mean you can list immediately |

| Preserve cash flow: Keep your money until closing |

| Let buyers customize: Some buyers prefer to choose their own contractors |

| Cons |

|---|

| Stronger buyer leverage: Inspection issues become major negotiating points |

| Potentially lower offers: Buyers pad offers with repair cushions, often estimating high |

| Loan approval risks: Lenders may require certain repairs before closing |

| Smaller buyer pool: Many buyers can't or won't take on significant repairs |

My Take: The Northern Indiana Strategy

After years of navigating South Bend and Elkhart County sales, here's what I recommend:

Fix proactively: Major safety issues (electrical panels, structural foundation problems), roof replacements if yours is over 20 years old, and HVAC if it's actively failing.

Leave for negotiation: Cosmetic issues, minor moisture fixes, and repairs under $2,000.

The sweet spot? Get a pre-listing inspection. For $350-$425 (typical cost in Northern Indiana), you'll know exactly what buyers will find. Then you can strategically address deal-killers while building repair credits into your pricing for smaller items.

One client recently sold a South Bend colonial. We knew the furnace was 22 years old, so we replaced it before listing for $4,500. The house sold for $15,000 over asking because buyers felt confident they weren't inheriting problems. Meanwhile, we left a small sump pump issue (estimated at $1,200) for negotiation and gave a $1,000 credit. Net result? They came out ahead by over $8,000 compared to addressing everything through negotiation.

The Bottom Line

Home inspections are going to find something—that's their job. In Northern Indiana, with our challenging climate and soil conditions, the big-ticket items tend to be roofs, HVAC systems, basement moisture, and electrical panels. Knowing these costs ahead of time gives you options: fix proactively to command top dollar, or price strategically and negotiate from a position of knowledge.

Either way, don't wait until your buyer's inspector is standing in your basement holding a flashlight and making concerned faces. By then, your negotiating power has already evaporated.

And remember: that furnace will pick closing week to get dramatic. It's physics. Or Murphy's Law. Probably both.

Thinking about selling your home near Notre Dame? I'm Tim Vicsik, a RE/MAX 100 Realtor specializing in the South Bend area. Let's talk about getting your home inspection-ready—or building the right strategy for your situation. Call me at 574-329-9587, email Tim@TimVicsik.com, or visit ND-Condos.com for more local market insights.

Categories

- All Blogs (75)

- Best Time To Sell (5)

- Condos and Villas (23)

- Elkhart (35)

- For Buyers (55)

- For Sellers (27)

- FSBO (14)

- Granger (32)

- Guides (41)

- Housing Market (38)

- Housing Trends (2)

- Inspections (4)

- Lifestyle (12)

- Market Trends (11)

- Mishawaka (33)

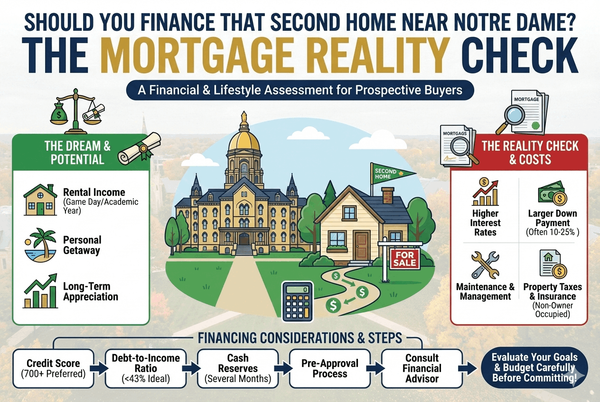

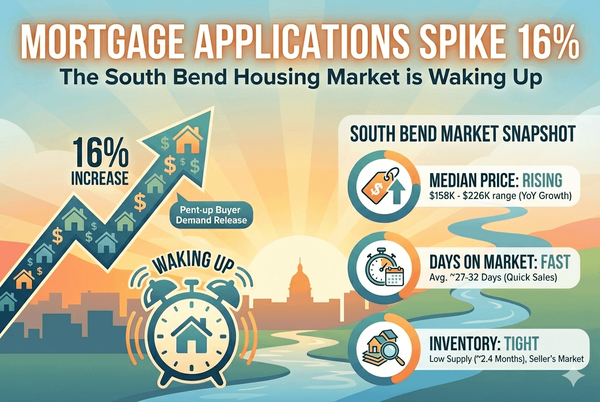

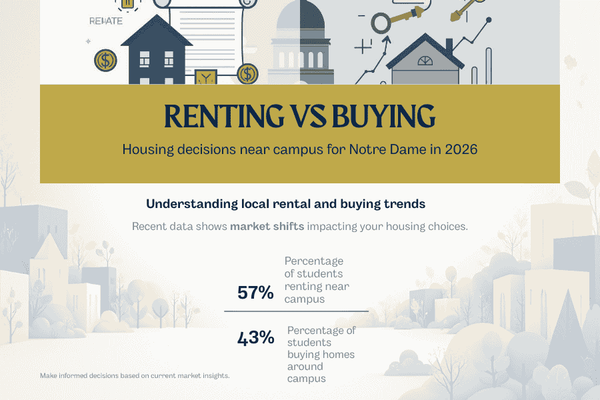

- Mortgage (17)

- Notre Dame (44)

- Property Tax (3)

- South Bend (57)

- Things To Do (5)

- Waterfront (5)

Recent Posts

GET MORE INFORMATION