Should You Finance That Second Home Near Notre Dame?

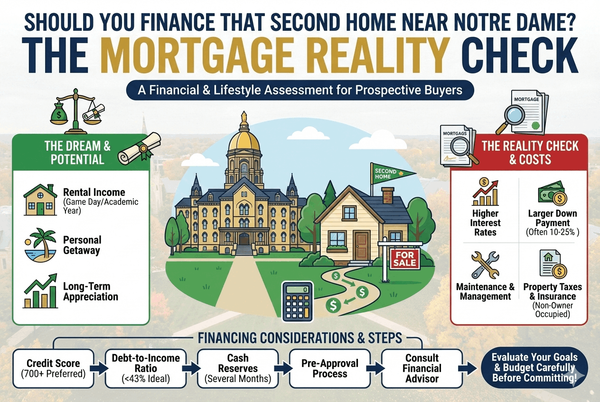

Should You Finance That Second Home Near Notre Dame? The Mortgage Reality Check

So you're eyeing a second property near the Golden Dome. Maybe it's a weekend escape from Chicago, a future retirement spot, or a rental investment that'll catch those game-day weekends. The question isn't whether South Bend is a smart choice (it is), but whether taking out a mortgage to make it happen is the right financial move for you.

Let's dig into what you're actually signing up for when you finance a second home in the Notre Dame area.

The Upside: Why Mortgages Make Second Homes Possible

You Keep Your Cash Working Elsewhere

Here's the thing about buying a $300,000 condo outright: that's $300,000 that's no longer earning returns in your retirement accounts, stock portfolio, or business. According to Federal Reserve data, mortgage rates for second homes typically run just 0.5% to 1% higher than primary residence rates. If you can beat that rate with other investments (and historically, diversified portfolios have averaged around 10% annually over the long term), the math starts favoring borrowed money.

Leverage Is a Powerful Tool

Put down 20% on that South Bend property, and you control 100% of its appreciation. If the home value increases 5% in a year, that's a 25% return on your actual cash invested. Real estate near Notre Dame has shown steady appreciation thanks to the university's stability and ongoing development in the area. Your mortgage lets you amplify those gains.

Tax Deductions Can Add Up

Under current tax law, you can deduct mortgage interest on up to $750,000 of combined debt for your first and second homes. Property taxes are also deductible (up to the $10,000 SALT cap). If you're in a higher tax bracket, these deductions can meaningfully offset your borrowing costs. Just remember: tax laws change, and you'll want to consult with your accountant about your specific situation.

Building Equity While You Enjoy It

Every mortgage payment chips away at the principal. Unlike rent (which builds equity for someone else), your monthly payment is partially an investment in yourself. After 15 or 30 years, that second home is paid off, and you own it free and clear.

The Downside: What They Don't Always Tell You

Higher Rates and Bigger Down Payments

Second home mortgages aren't treated like primary residences. Lenders see them as riskier because, in a financial crunch, borrowers prioritize the home they live in. Expect to pay that extra 0.5-1% in interest, and plan on putting down at least 20% (sometimes 25%). On a $300,000 property, that's $60,000-$75,000 upfront.

Two Properties Mean Double the Expenses

Mortgage payments are just the start. You're now covering insurance, property taxes, HOA fees, utilities, maintenance, and repairs on two properties. That South Bend condo might have a $200/month HOA fee. The furnace could fail. The roof might need replacing. These costs don't pause just because you're not using the property.

Market Risk Cuts Both Ways

Remember that leverage we talked about? It amplifies losses too. If property values dip 5%, you've lost 25% of your down payment equity. While the Notre Dame area tends toward stability, no market is completely immune to downturns.

Debt-to-Income Ratios Get Tight

Lenders count your second mortgage against your debt-to-income ratio, even if you plan to rent the property out. This can limit your borrowing power for other purposes and might affect interest rates on future loans. If you're planning any major financial moves in the next few years (business loan, primary home upgrade, etc.), factor this in.

Less Flexibility Than Cash Buyers

When you finance, you're on the lender's timeline. Mortgage processes take 30-45 days, and deals can fall through if financing doesn't materialize. Cash offers move faster and often negotiate better prices. In a competitive market around Notre Dame, that speed advantage matters.

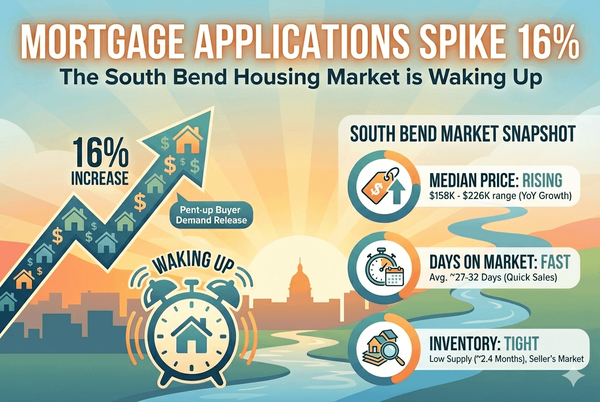

The Notre Dame Factor: Local Market Considerations

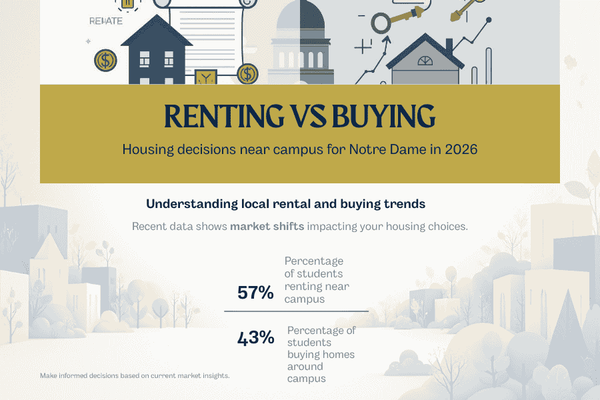

South Bend isn't a typical second-home market. The university creates unique dynamics. Football weekends can generate substantial rental income if you go that route. The academic calendar means predictable vacancy periods. And Notre Dame's endowment and long-term stability provide a foundation that many college towns lack.

But that also means competition. Alumni eyeing retirement properties, parents wanting a home base for student visits, and investors targeting football weekend rentals all create demand. A mortgage gives you buying power to compete, but it also commits you to payments whether or not rental income materializes as expected.

So What's the Verdict?

Mortgages aren't inherently good or bad. They're tools. The right answer depends on your financial picture, risk tolerance, investment timeline, and what you want from this second home.

A mortgage makes sense if you can comfortably afford the payments, you have other investments earning solid returns, you plan to hold the property long-term, and you want to preserve liquidity for other opportunities. It's less appealing if you're stretching to afford payments, you're near retirement and want to minimize debt, or you're uncomfortable with leverage risk.

Questions? Let's Talk Through Your Specific Situation

Every buyer's financial picture is different. Interest rates, loan terms, tax implications, and property-specific factors all play into whether financing makes sense for your second home near Notre Dame.

I work with experienced mortgage lenders who specialize in second homes and investment properties in the South Bend area. They can run the numbers for your specific situation and help you understand what financing actually costs versus what marketing materials promise.

Ready to explore your options? Give me a call at 574-329-9587, email Tim@TimVicsik.com, or visit www.ND-Condos.com to start the conversation.

Tim Vicsik is a RE/MAX 100 Realtor specializing in condos and homes for sale near the University of Notre Dame in South Bend, Indiana.

Categories

- All Blogs (70)

- Best Time To Sell (5)

- Condos and Villas (21)

- Elkhart (34)

- For Buyers (50)

- For Sellers (24)

- FSBO (12)

- Granger (31)

- Guides (39)

- Housing Market (34)

- Housing Trends (2)

- Inspections (3)

- Lifestyle (13)

- Market Trends (12)

- Mishawaka (32)

- Mortgage (19)

- Notre Dame (40)

- Property Tax (3)

- South Bend (52)

- Things To Do (5)

- Waterfront (5)

Recent Posts

GET MORE INFORMATION