How Often Do Contingent Offers Fall Through in South Bend?

How Often Do Contingent Offers Fall Through in South Bend?

October 2025 • by Tim Vicsik, REALTOR® – RE/MAX 100

If you’ve bought or sold a home in the South Bend area recently, you’ve probably come across contingent offers — contract terms that have to be met before a sale can close. But how often do these actually cause a deal to fall apart?

The short answer: not very often, but it depends on the market and the situation.

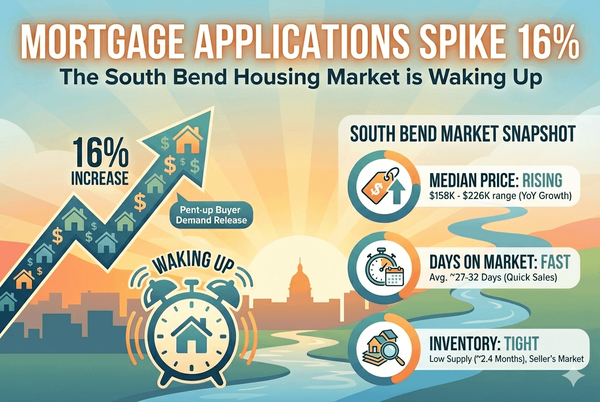

According to the National Association of REALTORS® (NAR), around 6% of home purchase contracts nationwide were terminated in the months leading up to June 2025. Locally, that number can fluctuate depending on interest rates, home prices, and buyer confidence — all of which have shifted a bit in 2025.

Let’s take a closer look at how often contingent offers fall through, what usually causes it, and how South Bend buyers and sellers can keep their deals on track.

How the South Bend Market Impacts Contingencies

Contingent offers tend to fall through more often when market conditions change. Over the past year, higher mortgage rates and tighter lending standards have made buyers a bit more cautious, especially around Notre Dame area condos, Granger villas and homes, and homes in Mishawaka.

A Redfin report estimated that about 15% of pending sales nationwide were canceled in August 2025 — the highest August rate since 2017. The top reasons were:

-

Inspection or repair issues – 70%

-

Financing problems – 28%

-

Buyer’s home didn’t sell – 21%

-

Changes in financial situation – 15%

Locally, inspection issues are still the main culprit. Homes built before the 1970s often uncover hidden surprises — outdated electrical, foundation settling, or old plumbing that makes buyers think twice.

What Exactly Is a Contingent Offer?

A contingent offer means the buyer will move forward if certain conditions are met. These conditions protect buyers and can include inspections, financing, appraisals, and even the sale of their current home.

Example: A buyer makes an offer on a vintage South Bend home near Notre Dame, contingent on the roof being replaced. If the inspection reveals the shingles are at the end of their life and the seller won’t replace them, the buyer can walk away without losing their earnest money.

Common Reasons Contingent Offers Fall Through in St. Joe County

Here are the main factors I see affecting deals in our market:

-

Inspection concerns: Older homes often need updates or repairs that buyers aren’t willing to take on.

-

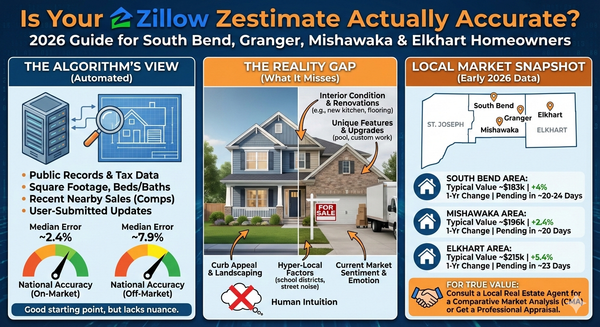

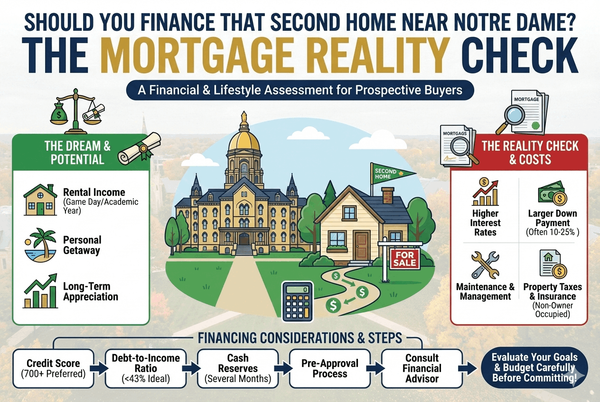

Financing issues: Interest rate changes or tighter lending standards can knock a buyer out of qualification.

-

Low appraisals: When prices rise faster than comparables can support (common near campus), appraisals sometimes come in short.

-

Home sale delays: Buyers moving from out of state or trying to sell in another market sometimes miss their sale deadline.

-

Title problems: Usually rare, but things like unpaid taxes or liens can still cause hiccups.

Key Contingencies Explained

-

Financing contingency: Protects buyers if their mortgage isn’t approved. Even pre-approved buyers can hit snags during underwriting.

-

Appraisal contingency: Ensures the home’s appraised value meets or exceeds the agreed price. Low appraisals are not uncommon when bidding wars occur.

-

Inspection contingency: Gives buyers time to review a professional inspection and request repairs or credits.

-

Title contingency: Confirms clean ownership and no hidden liens.

-

Home sale contingency: Lets a buyer sell their current home first — common for move-up buyers, though less appealing to sellers.

Should You Submit or Accept a Contingent Offer?

Contingencies aren’t deal-killers — they’re safety nets. Waiving them can make an offer more competitive, but it also raises the risk of financial surprises later.

If you’re a buyer, make sure your finances are solid before waiving protections. If you’re a seller, evaluate how strong the buyer’s position is. A contingent offer backed by a solid pre-approval or a pending sale can still be worth considering.

How to Keep the Deal Together

For Buyers:

-

Get fully pre-approved before making an offer.

-

Don’t make big financial changes mid-process.

-

Know the age and condition of what you’re buying — especially older South Bend homes.

-

Expect some back-and-forth on inspections and repairs.

For Sellers:

-

Consider a pre-listing inspection to spot issues early.

-

Be realistic about pricing and repairs.

-

If you have multiple offers, ask your agent about setting a backup offer.

-

Keep timelines tight — shorter inspection periods can help prevent cold feet.

FAQ: Contingent Offers in the South Bend Market

Do contingent offers fall through often here?

Not usually. Most transactions close successfully, but inspection and appraisal issues are the top reasons for cancellations.

Do they take longer to close?

Yes, sometimes. Standard contingency timelines add 10 to 30 days to the typical closing, depending on the situation.

Are sellers open to them?

It depends on the market. In slower seasons (like winter), sellers tend to be more flexible. In spring, when Notre Dame buyers and investors flood the market, sellers often prefer clean offers.

Can a seller back out?

Only under specific contract terms — otherwise, they risk losing the deal and facing potential legal issues.

Bottom Line

Contingent offers don’t fall through as often as people think — but they do require communication, flexibility, and a clear understanding of what’s in the contract. Whether you’re buying a downtown condo or selling a home in Granger, working with an experienced local REALTOR® can make all the difference.

Tim Vicsik - Realtor

RE/MAX 100

(574) 329-9587

Tim@TimVicsik.com

www.ND-Condos.com

Categories

- All Blogs (73)

- Best Time To Sell (5)

- Condos and Villas (22)

- Elkhart (34)

- For Buyers (54)

- For Sellers (26)

- FSBO (13)

- Granger (31)

- Guides (41)

- Housing Market (37)

- Housing Trends (2)

- Inspections (3)

- Lifestyle (12)

- Market Trends (10)

- Mishawaka (32)

- Mortgage (17)

- Notre Dame (43)

- Property Tax (3)

- South Bend (55)

- Things To Do (5)

- Waterfront (5)

Recent Posts

GET MORE INFORMATION